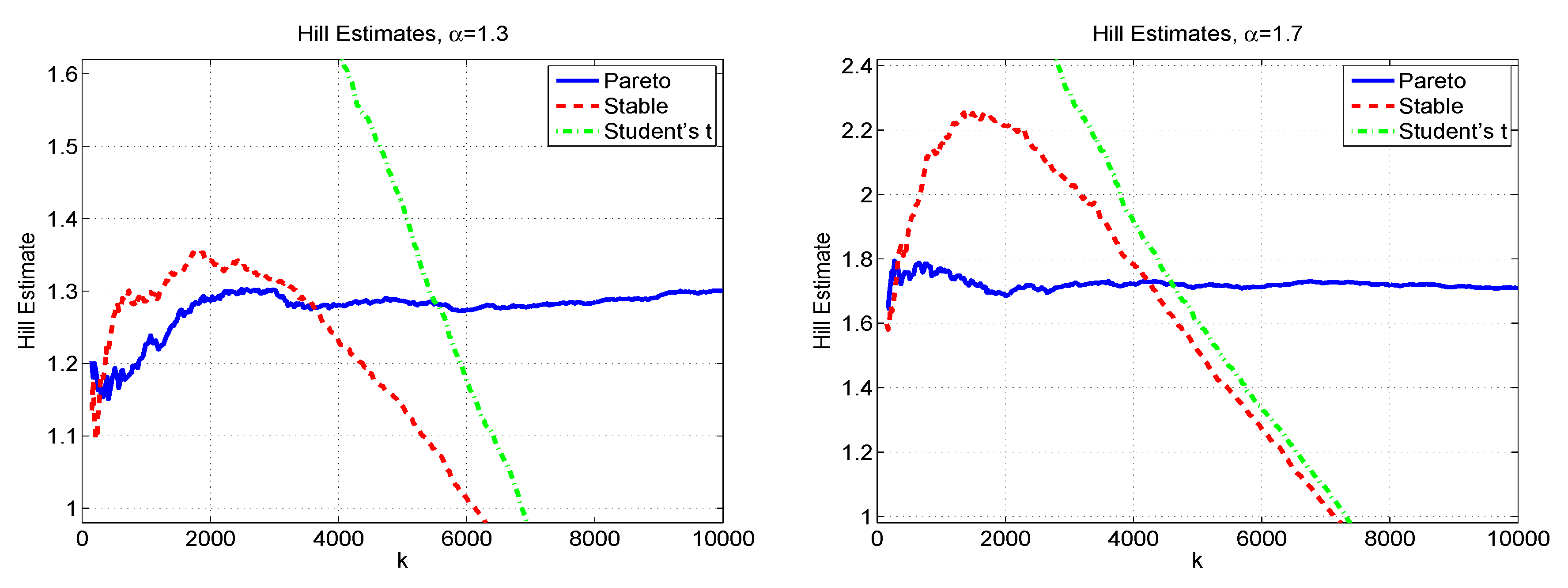

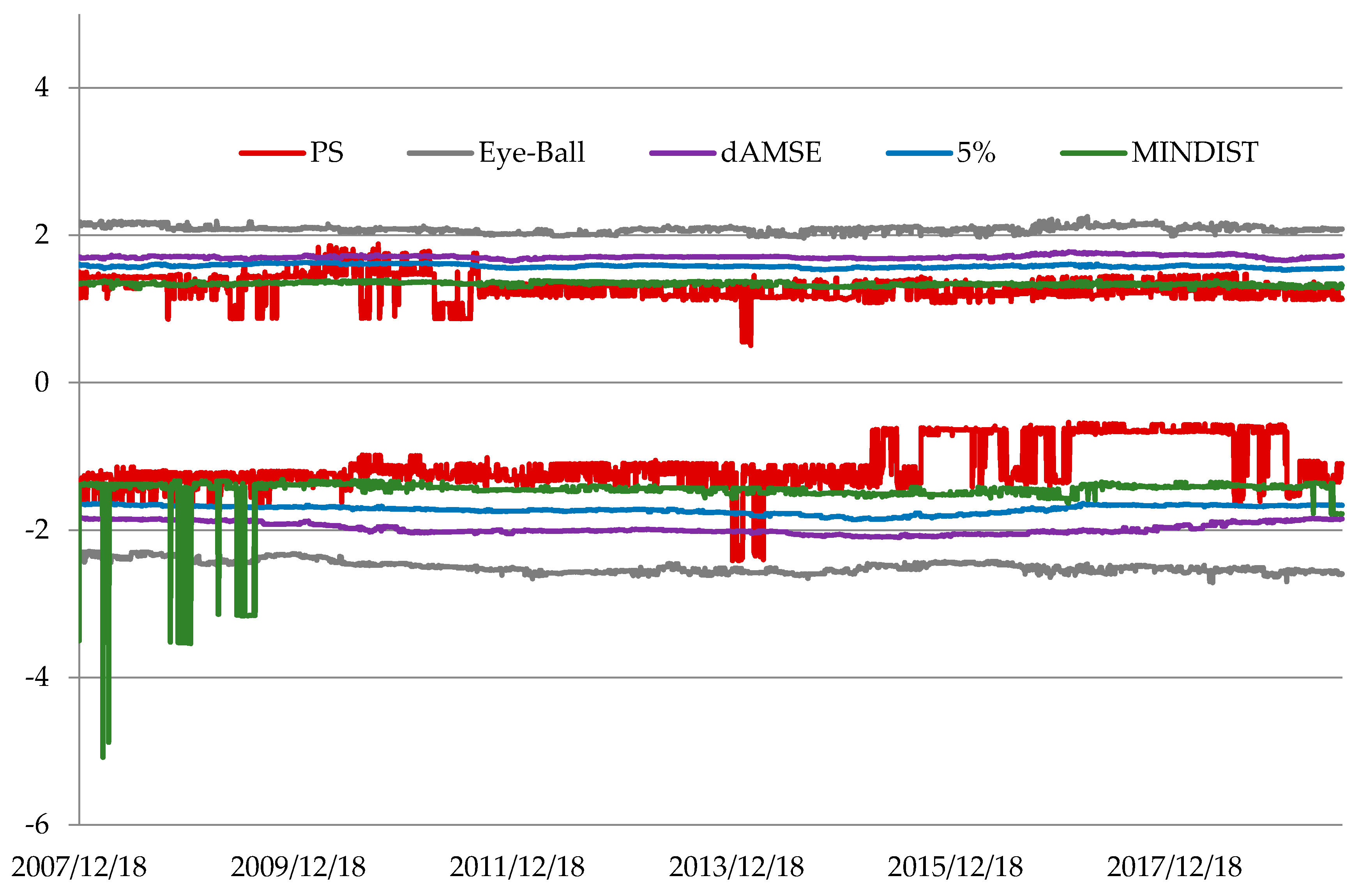

Mathematics | Free Full-Text | Value at Risk Estimation Using the GARCH-EVT Approach with Optimal Tail Selection

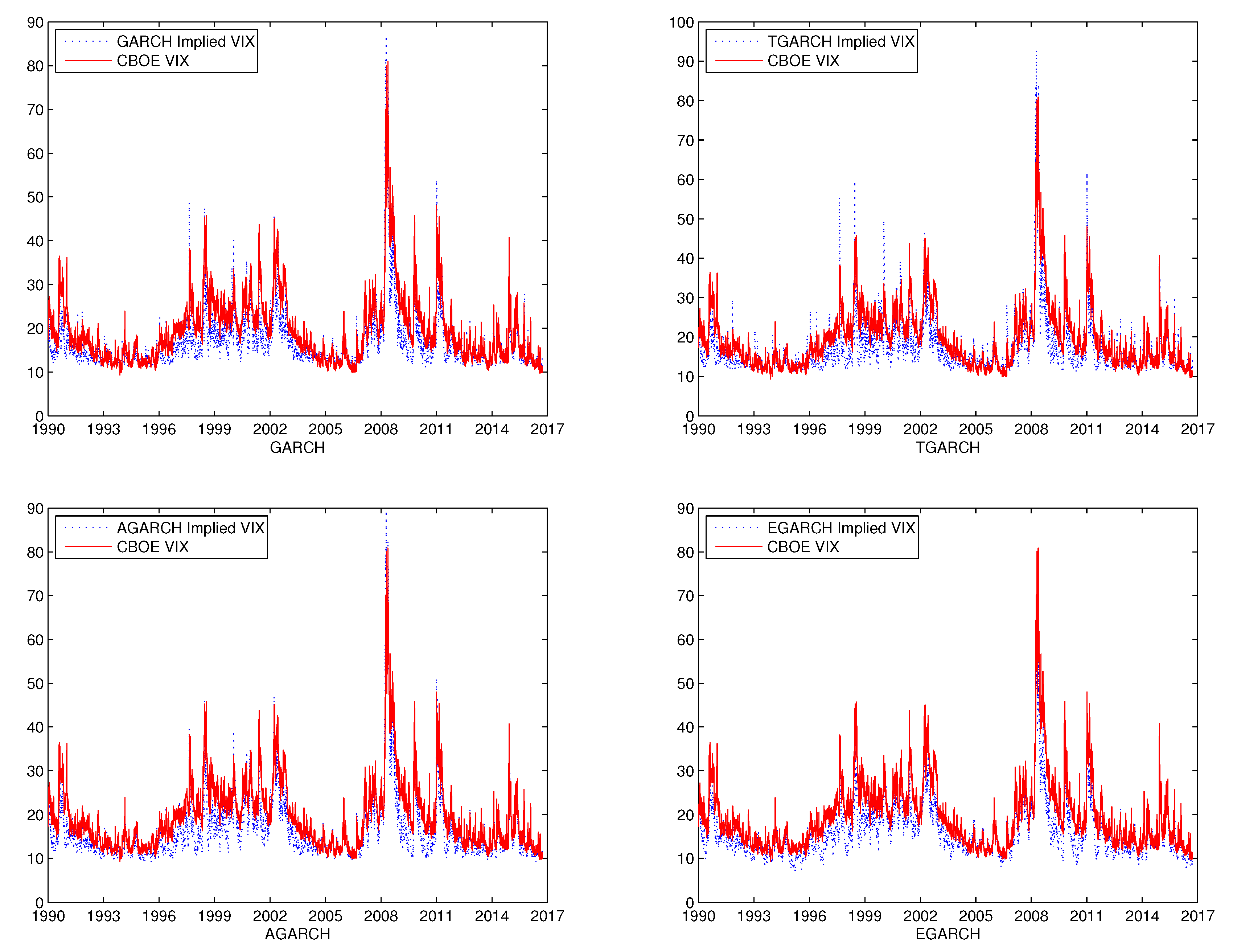

Comparison of the price surfaces of TVOs obtained from semi-closed-form... | Download Scientific Diagram

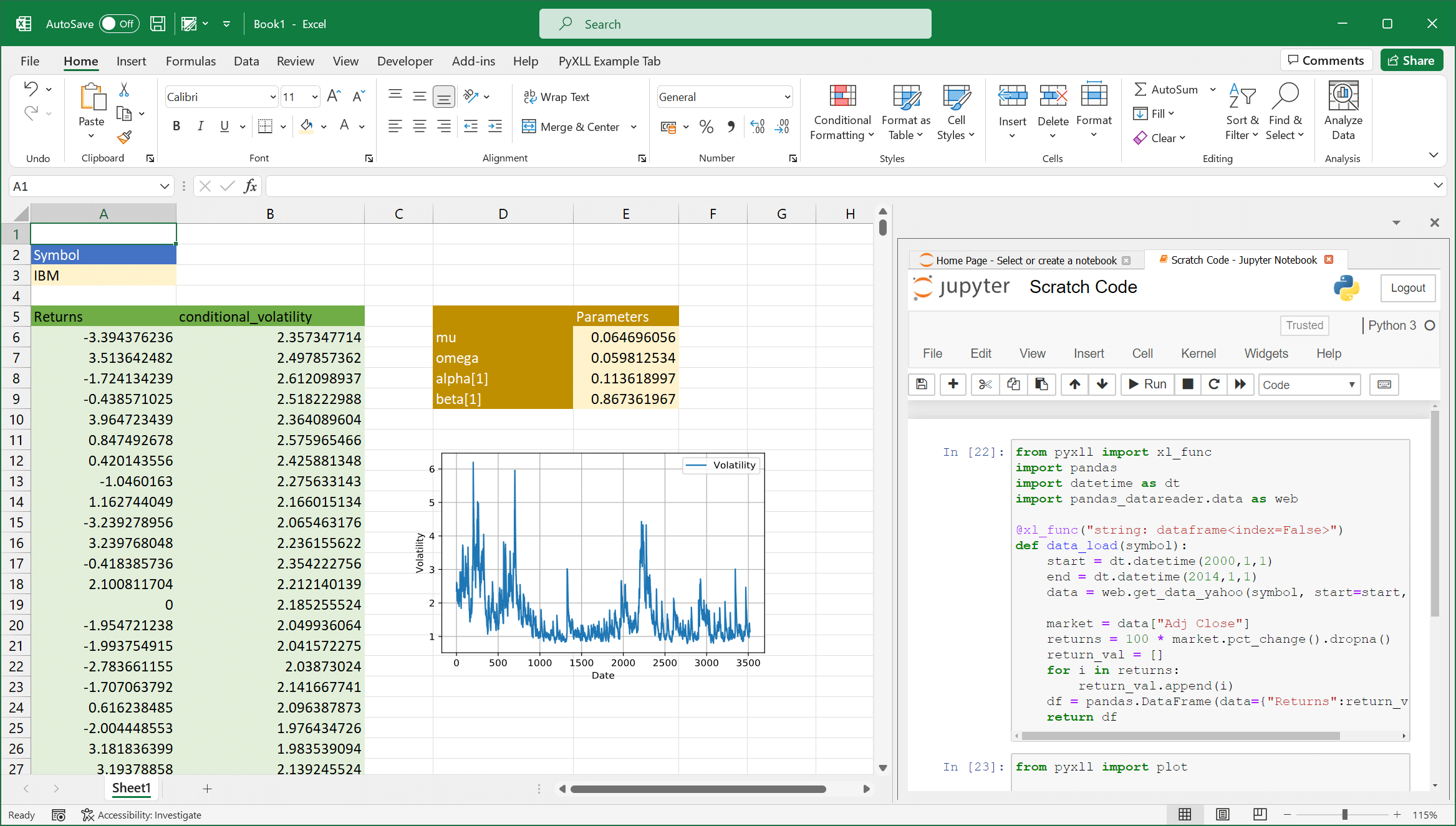

r - GARCH(1,1) volatility forecast looks biased, it is consistently higher than Parkinson's HL vol - Cross Validated